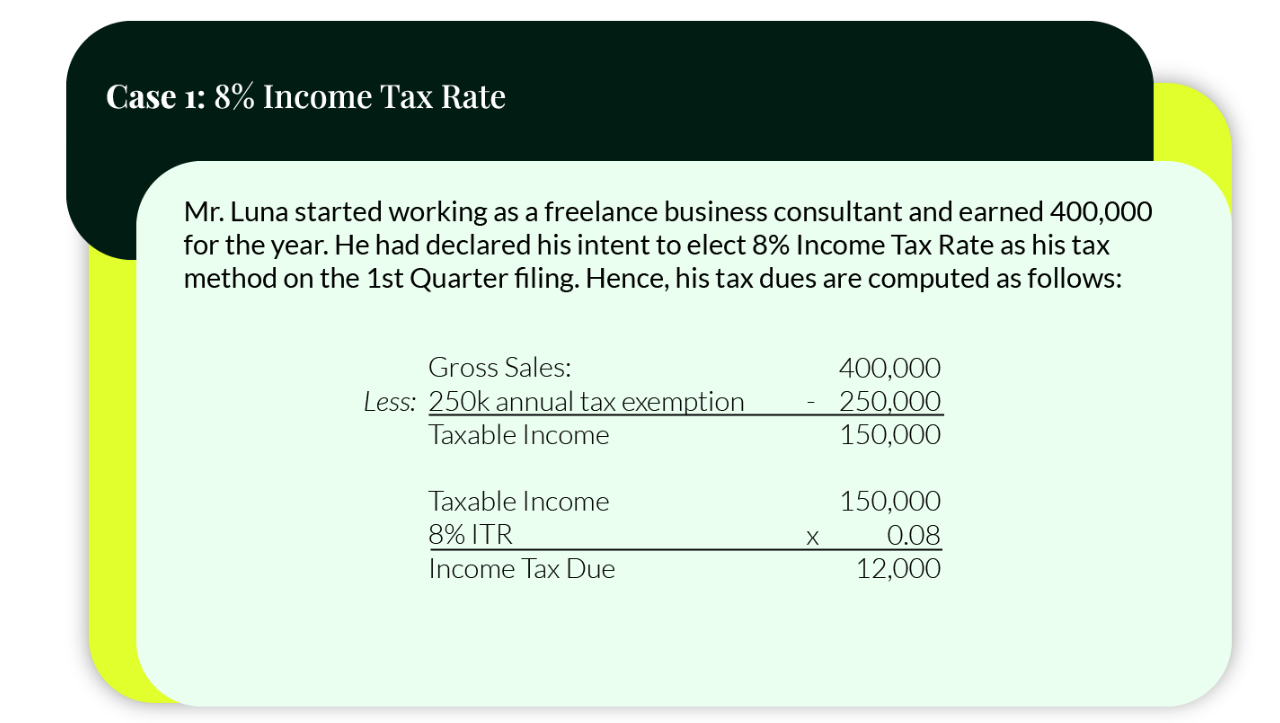

Learn all about the different tax methods and their respective tax deduction process from Income Tax Rates and Percentage Tax.

Income Tax Rates

Graduated Income Tax Rates

This Tax Table is used by taxpayers who opted to the Graduated Income Tax Rate or those who did not signify their intent to be taxed at 8% at the beginning of the tax year.

| RANGE OF TAXABLE INCOME | TAX DUE | |||

| OVER | NOT OVER | BASIC AMOUNT | ADDITIONAL RATE | OF EXCESS OVER |

| – | 250,000.00 | – | – | – |

| 250,000.00 | 400,000.00 | – | 15% | 250,000.00 |

| 400,000.00 | 800,000.00 | 22,500.00 | 20% | 400,000.00 |

| 800,000.00 | 2,000,000.00 | 102,500.00 | 25% | 800,000.00 |

| 2,000,000.00 | 8,000,000.00 | 402,500.00 | 30% | 2,000,000.00 |

| 8,000,000.00 | – | 2,202,500.00 | 35% | 8,000,000.00 |

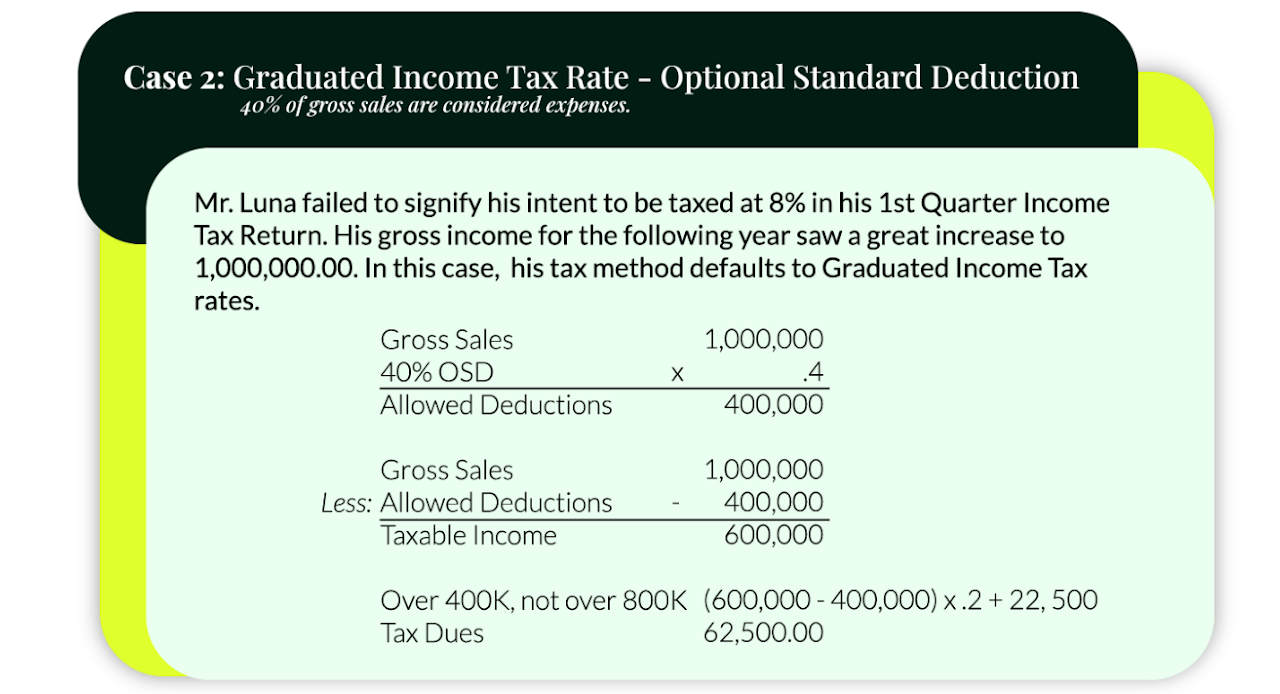

GRADUATED INCOME TAX – Optional Standard Deduction

Using the tax table above, Mr. Luna’s taxable income falls over 400,000 and not over 800,000.

Which means that you must pay the basic amount of P22,500.00 + the 20% of the excess (of his taxable income) over 400,000.

In this case, Mr. Luna’s tax due is computed as:

Tax Due = Basic Amount + (Additional Rate * [Of Excess Over – Taxable Income])

22,500 + [.20 (600,000 – 400,0000)] = 80,000

With the Graduated Tax Income Rate using Optional Standard Deduction, Mr. Luna’s annual tax due based on his gross income is P62,500.00.

PERCENTAGE TAX

Since Mr. Luna is under the Graduated Income Tax method, he is also subject to an additional 3% percentage tax based on his annual gross income.

In this case his percentage tax rate is computed as follows:

Pecentage Tax = Annual Gross Income / 4 x 0.03

1,000,000 / 4 x 0.03 = 7,500

With every quarter, Mr. Luna must file and pay P7,500.00 percentage tax on top of his quarterly income tax dues.

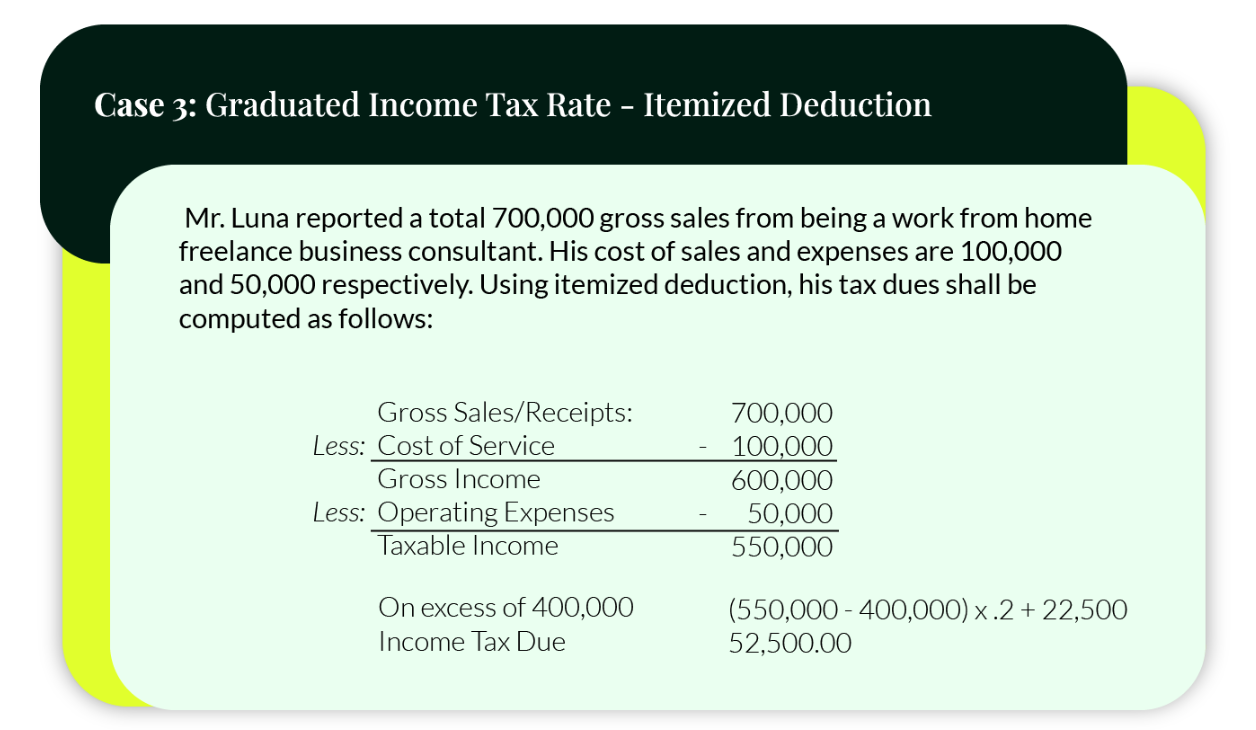

GRADUATED INCOME TAX – Itemized Deductions

Itemized deductions allow you to further minimize your tax dues by providing a list of business expenses, such as operating costs, equipment, professional fee, etc. These expenses are then tallied and recorded to your Book of Accounts. Each item must be supported by their respective official receipts and amended to your tax-filing documents to BIR, where they will review your documents and deduct the applicable expenses from your tax dues.

PERCENTAGE TAX

Since Mr. Luna is under the Graduated Income Tax method, he is also subject to an additional 3% percentage tax based on his annual gross income.

In this case his percentage tax rate is computed as follows:

Pecentage Tax = Annual Gross Income / 4 x 0.03

700,000 / 4 x 0.03 = 5,250

With every quarter, Mr. Luna must file and pay P5,250.00 percentage tax on top of his quarterly income tax dues.

With these tax methods, which actually yields to more deductions and less taxable income?

It actually depends on your own income and expenses for each tax year. The best way to find out is to consult with an accountant to help you optimize your tax deductions. Remote Staff provides regular tax consultations for contractors who join our Tax Help Program.

Disclaimer:

The information in this site for general guidance is not intended to replace or serve as a substitute for any audit, advisory, tax, legal, or other professional advice, consultation, or service. We strongly recommend that you consult an accountant before making any decision regarding your taxes. Remote Staff will not be responsible for your tax compliance as a result of the misuse or abuse of the content herein. You should not send any confidential information to Remote Staff until you have received agreement from the company to perform the services you request.